Last Updated on April 29, 2023 by Flavia Calina

You should keep records of your mileage driven for many reasons, especially if you’re a small business owner or employee. These records can help you claim mileage deductions and maximize tax benefits.

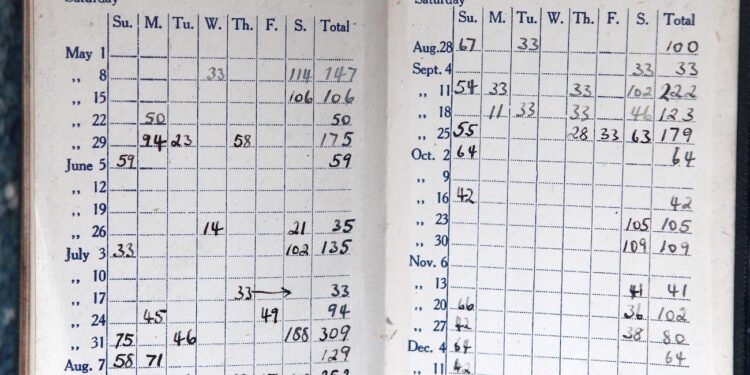

Paper logbooks and spreadsheets are low-cost options for recording mileage. However, they’re prone to errors and are time-consuming. Expense management systems are another option, but they require drivers to enter trip details manually.

It’s Legal

If you’re a driver, you may want to keep records of your mileage driven for various reasons. For example, if you use your vehicle for work and need to deduct the cost of business trips, it’s essential to be able to document these miles.

Whether you’re a sole proprietor, a self-employed contractor, or an employee reimbursed for business travel expenses by your employer, following all of the IRS’s record-keeping requirements is essential. If you don’t, you could lose out on a significant tax deduction or face problems with the IRS when it comes time to file your taxes.

The IRS requires keeping contemporaneous records of your business-related driving and travel expenses. This means you must track your mileage at the exact moment you’re traveling rather than reconstructing your activities months or years later.

There are several ways to keep track of your mileage, including manual tracking or an electronic mileage log. If you choose to use an electronic record, ensure it meets all of the IRS’s standards for documentation.

You can also use a smartphone app to track your mileage based on your GPS location. This will make it easier to clearly understand your actual trips and how much time you spend on them.

Another advantage of using a smartphone app is that it’s often much more convenient than taking a daily reading of your odometer. Alternatively, you can also use a paper logbook to record your trips.

It’s Easy

Whether an employer or a business owner, keeping records of mileage driven for tax purposes is essential, this can help you get a larger tax deduction and save money on your taxes.

The IRS requires that you keep an accurate record of your business miles to claim a valid tax deduction. This is especially important if you use your car for business trips.

Several methods exist to keep your mileage records, including using a spreadsheet or an app. However, using an app that automatically logs your miles is the easiest way.

This method will be much easier and quicker than updating a spreadsheet. It also lets you see the total mileage you have logged at the end of the year, which can be a huge time-saver!

Another easy way to track your miles is to use a digital logbook to store all the necessary information. The record should contain the following information for each trip: the date, your odometer reading at the beginning and the end of the trip, the purpose of the journey, and the destination.

You should also include any additional information that may help you prove your mileage, such as receipts for any refuelings, garage rent, insurance, licenses, tires, or tolls. This will allow you to maximize your mileage deductions and avoid potential audits.

It’s Convenient

Keeping records of your mileage driven is one of the most convenient ways to manage business travel expenses. It can also help you save money on taxes.

In the past, claiming reimbursements and tax deductions for mileage took a lot of work. Drivers relying on pen and paper to record their business miles were susceptible to fraud, miscalculation, and error.

To ensure accuracy, record odometer readings at the start and end of each trip. Additionally, record the destination and the purpose of the business drive.

Accurate records make it easy for your company to calculate mileage as a business expense and ensure you receive the total deductible amount you deserve.

This is especially true for rideshare and delivery drivers who spend much time on the road.

It’s essential to keep accurate and thorough records of each driver’s mileage, regardless of vehicle type. A simple spreadsheet is a great way to document miles.

You can also use an app that tracks your driving habits for more detailed records. Those apps usually offer the option to take a picture of your odometer at the beginning and end of each trip.

These digital tools are much more efficient than logging trips with pen and paper. You can also back up electronic logs regularly to prevent the loss of records.

It’s Time-Saving

Keeping records of your mileage driven is essential for tax purposes and can save you time in the long run. You’ll better understand your driving habits, which can help you save money on insurance, car repairs, and vehicle depreciation in the future.

A mileage tracking app is one way to track your trips easily. These apps automatically detect your location, record the miles you drive, and send reports to document deductions.

Another option is to use a paper logbook or an Excel spreadsheet. These are easy to set up but can be time-consuming to maintain. You’ll need to record each business trip with the date, the odometer reading at the beginning and end of the journey, and a description of the purpose of the trip.

For example, you may need to record that you are traveling to a client’s home or to pick up a delivery from your local grocery store. If you do this, you can subtract the miles you drove from the total miles to calculate your mileage for personal use.

The IRS has rules regarding how to track your mileage for tax purposes, so you must keep your mileage log accurate and up-to-date. This will not only help you qualify for a tax deduction, but it can also prevent fraud.

Read more interesting articles on Today world info