Last Updated on October 10, 2022 by admin

Diversify Your Portfolio

Investing in gold is a great way to diversify your portfolio and reduce your risk of inflation. It also offers the benefits of diversification, which means you can gain exposure to the different drivers that drive the prices of the different precious metals.

The following article provides an overview of how to diversify with gold. Investing in gold has many benefits, but it also has its risks. It’s not always clear when to buy or sell. Additionally, you don’t get cash flow, so there’s a lot to consider!

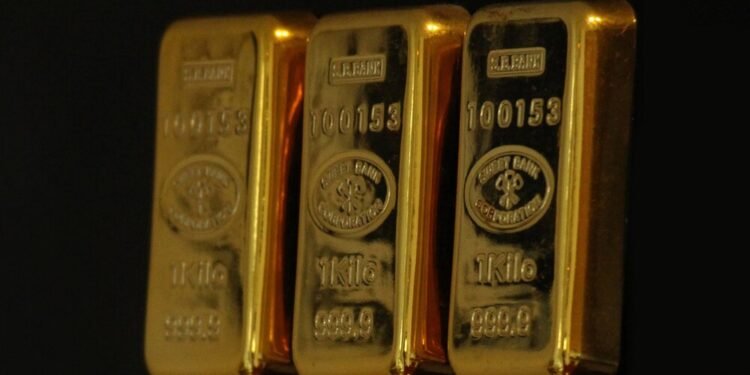

Investments in physical gold

Physical gold can be purchased from jewelry and pawn shops, and can also be purchased through a broker. It is important to note that physical gold is taxed as ordinary income if you own it for less than one year. The maximum tax rate is 28% (www.journalofaccountancy.cominvesting-in-gold). In addition, you will need to pay for insurance and storage.

This means you’ll have to rely on the earnings of a company to support your gold investment. Physical gold is not an extremely liquid asset and can be stolen, so you need to invest in proper storage. You must also have adequate insurance to keep your precious metal safe. Physical gold is also an affordable way to own gold.

Many experts, including Jim Cramer, suggest investing in physical gold because it’s a great insurance policy. Many professional investors consider physical gold as a hedge against financial risks. Historically, gold has exhibited a low correlation to stocks and has an inverse relationship to the US dollar.

Economic Bubble

In the past decade, there were two major recessions, triggered by the burst of the new economic bubble and the mortgage scandal. In addition, government debt in most developed nations has increased dramatically. This has increased the need for physical products, including gold. While gold may seem like an investment that offers significant upside potential, it may not be the most profitable option for everyone.

The best time to invest in gold is when it is inexpensive and the sentiment is negative. In addition, it’s always best to diversify your portfolio with several different kinds of assets, such as stocks, bonds, and other assets. If you want to invest in physical gold, make sure you understand the risks and tax implications.

There are many exchange-traded funds that offer exposure to gold. There are also some mutual funds that are based on gold prices. Some of these are index funds, while others track industry trends. You can also invest in individual gold mining companies through a mutual fund or exchange.

Investing in gold ETFs

Gold ETFs are a convenient way to invest in this popular asset class. Investors use them to diversify their portfolios and can also use them as a hedge against inflation or geopolitical unrest. Gold is an asset that does not fluctuate like stocks or bonds, and can grow in value during times of uncertainty.

In addition, these ETFs offer low fees and liquidity, making them ideal for novice investors. Gold ETFs are traded on an exchange just like stocks do, and you can purchase one with an online broker. Some platforms will charge a transaction fee to purchase the funds, but these are usually the same as commissions on stock transactions.

The easiest way to invest in gold ETFs is to use dollar-cost averaging, which is a strategy that involves buying and selling at the lowest price while simultaneously limiting your risk of overexposure to one asset. Some platforms, such as Ally Invest, make this simple and convenient.

Investing in gold can be done in a number of ways, including buying gold bullion or owning shares of gold-mining companies. But the most common method is through gold exchange-traded funds, or ETFs. Some of these gold ETFs invest directly in gold, while others manage a portfolio of gold-related stocks. Both options offer low costs and instant diversification.

Mitigate the Effects

GLD is one of the most popular gold ETFs. Diversifying your portfolios with gold is an excellent way to mitigate the effects of inflation. As a safe haven, gold increases in value during times of high inflation. And because of its low correlation to stocks and bonds, gold is a perfect asset for diversification.

Whether or not to diversify your portfolios with gold depends on your personal goals and risk appetite. You should also check out the Yahoo review of any dealer you’re interested in purchasing from. Generally, you should invest at least ten percent of your portfolio in gold to minimize risks and maximize profit potential.

While the majority of gold ETFs have low expense ratios, you should still compare their returns carefully before investing. In addition, you should watch for leveraged gold ETFs that aim to take advantage of short-term price movements. These can make for lower returns in the short run and help a larger yield eventually.